Queensland Property: 200% Olympic Boom?

With an 11 year runway to prepare for the 2032 Olympic Games, Propertyology evaluates the potential for Queensland house values increasing by 200% over that period.

Instead of everything happening in one major city, the unique nature of the 2032 Olympics will see several cities across the entire state of Queensland host sporting events for a combined 10,000+ athletes from 195 countries, plus their coaches, medical teams, media entourage and tourists (domestic and international).

Subsequent to first being announced as host of the single biggest event in the world, Queensland real estate values have already increased by between 40 and 80 percent. And that’s before a single sod of soil has even been turned on any of the major projects in the Olympic Games pipeline.

If that rate of capital grown from the last 4 years were to continue, the extrapolated result for the 11 years to 2032 would end up in the vicinity of 200%.

Whilst 200% is an extraordinary rate of growth, that’s precisely what was produced during the 11 years ending 2010 without an Olympics.

Among Australia’s strongest property markets in the 11 years ending 2010 were tropical Cairns (151% house price growth), the garden city of Toowoomba (173%) and the glittering Gold Coast (177%).

Even bigger growth was enjoyed by property owners in Townsville (190%).

Meanwhile, house values soared by 200% or more in the Scenic Rim, Mackay, Sunshine Coast, Fraser Coast, Brisbane (214%) and Rockhampton (229%).

Cautiously Confident

Personally, I am more enthusiastic about the impact of hosting the 2032 Olympic Games than I was when the IOC first announced Queensland as the host, back in July 2021.

Queensland’s leadership team, the state’s vision and the general narrative is vastly different now compared to this time 4 years ago.

Instead of totally wasting $0.9 billion on a ‘renovation’ of the small and seriously outdated Gabba, Queensland will be investing close to $5 billion into developing an exciting entertainment precinct on a grossly underutilised piece of inner city land at Victoria Point.

Finally committing to connecting the Sunshine Coast to Brisbane via passenger rail is a game-changer for Australia’s fastest growing jurisdiction.

The benefits to come from months of global marketing will be enormous for attracting future investment capital, supercharging visitor economies and increased internal migration.

Interest Rates

Interest rates currently looking like being significantly lower during the 11 year runway to the 2032 Olympics than the 11 years ending 2010.

During the 2000’s the RBA cash rate reached a ‘low’ of 4.2% in the early part of the period and a ‘high’ of 7.3% towards the end.

In the first 4 of 11 years leading into 2032, the RBA cash rate reached an ‘emergency low’ of 0.1%, then rose to a high of 4.35% and dropped back to 3.85% this month.

Migration

Over the 11 years to 2010, overseas migration added a net 400,000 to Queensland’s population while internal migrants added 275,000.

In comparison, when the actual migration numbers of the last 4 years are extrapolated over 11 years it equates to a whopping 686,000 net growth from overseas migrants and 395,000 from internal migration.

That level of population growth in 11 years would be enough to fill entire new regions comparable to the current size of Gold Coast and Sunshine Coast, respectively.

No Precedence

There is no question that hosting an Olympic Games (or Commonwealth Games) has a positive influence on a city.

The primary impact is generally across a 5 year period which consists of exaggerated construction activity during the 4 years directly prior, along with a boost to local confidence which can linger for up to 12 months after the event.

That said, it would be seriously delusional for anyone to think hosting a global sporting event is a guaranteed ticket to a property boom.

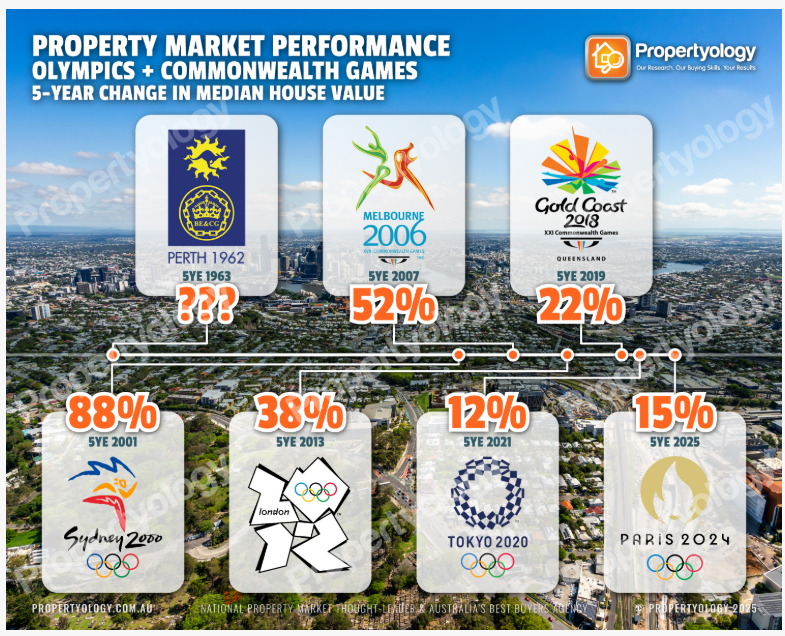

As recently as 2018, Gold Coast hosted the Commonwealth Games and, despite a record value of infrastructure investment, the region’s median house value increased by a modest 22% across 5 years of hosting the global event.

Melbourne’s property market during the period around the 2006 Commonwealth Games was stronger, but 52% capital growth in 5 years has been produced by hundreds of cities which did not benefit from the economic and emotional stimulus that comes from hosting major global events.

During the years surrounding the 2000 Olympic Games, Sydney experienced a property boom.

But playing host to the global sporting event was not the primary cause. The strong national economy, readily available credit, major tax reform (GST implementation) and widespread aspiration collectively produced souring real estate values across the entire country.

Unknowns

Trust be known it is impossible to be certain what will happen in any city over the next 3 years let alone 7 years. There are umpteen factors which influence property market performance.

It is reasonable to assume that internal migration throughout the entire state of Queensland will continue to be strong, and that housing supply will remain very tight.

Whilst Brisbane’s construction sector will have an abundance of work for many years to come, the major project pipeline is nowhere near as deep in Queensland’s capital city as what most cities who host an Olympic Games experience.

The unknown outlook for other key sectors such as tourism, education, agriculture, mining and manufacturing will have a significant influence on household incomes, household confidence and Queensland’s real estate activity over the next 7 years.

Similarly, it is anyone’s guess what might happen with credit policy (APRA), with monetary policy (RBA), with economic policies and taxes (state and federal), conditions for international trade and political stability.

Challenges

Attracting enough skilled labour will be one of Queensland’s biggest challenges. The construction sector has a massive battle ahead to support supply of new housing, to complete new infrastructure on time and to minimise project cost blowouts.

Industry sources have already voiced concern that Queensland is at risk of having a 30,000 hotel room shortfall by 2032.

Future global commodity prices always play a major role in Queensland’s economy.

The global price of coal, gas, copper, zinc, gold and lead determine whether Queensland receives $3 billion per year from mining royalties, $15 billion per year, or somewhere in between.

Now more than ever, Queensland will need every penny. The sizeable state government debt and pressure to meet Olympic Games commitments has already resulted in the recent shelving of several big infrastructure projects.

The new state government has a significant challenge to manage the high monthly interest bill, to curtail public sector waste, to fund major projects and to resist the introduction of new taxes.

Apples and Oranges

The wide-ranging property market inputs from one era to the next will never be identical.

Whilst Brisbane’s median house value increased from $143,000 to $449,000 (or 214%) over 11 years to 2010, the following 11 years was a noticeably lower 74% rate of growth.

If we split the difference of the 2 periods at 145%, Brisbane’s median house value would be $1.9 million in 2032.

All things being equal, by the time sprinting sensation Gout Gout runs into the world-class stadium at Victoria Park and lights up the Olympic cauldron in July 2032, the value of a standard house in Brisbane’s mid-outer ring is likely to have increased from a starting point of $783,000 in July 2021 to between $1.7 million (120% growth) and $2.5 million (215% growth).

Whatever happens in Brisbane, similar (or better) rates of growth are possible for Cairns and Townsville in the far north, inland in Toowoomba and Scenic Rim, in the beautiful Fraser Coast region, and on the Sunshine Coast and Gold Coast.

Anyone contemplating putting capital into Australian property markets would be wise to consider all of the aspects which define making a truly intelligent property investment decision.